Microsoft office 2016 16 16 6 vl download free. Your request for information was submitted successfully. A Ricoh professional will contact you shortly. Paperless 3.0.80 - Digital documents manager. Download the latest versions of the best Mac apps at safe and trusted MacUpdate.

Screens 4 7 25. Paperless is a manager of digital documents. Remember when everyone talked about how soon we could be a paperless society? Now it seems that we use more paper than ever. Let's face it, we need and use paper. However, Paperless is one of those incredibly useful applications to help you manage all your paper and digital documents and at the same time, positively affect the environment.

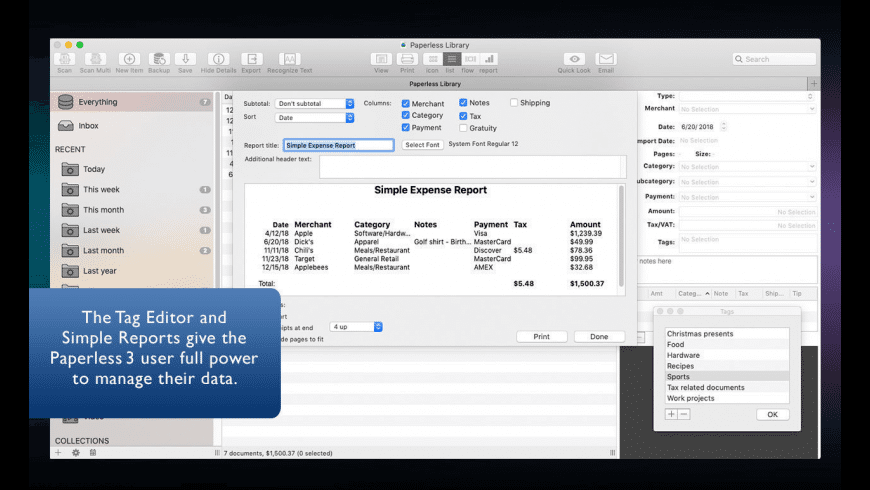

When it comes tax time, no need to bring a shoebox full of receipts to your accountant. According to the judgment Rev. Proc. 97-22 IRS, a digital document is acceptable. With Paperless 3 can create a smart collection and keep all of your documents organized and sorted in one place. Chronoburn 2 4 6 – track calories in real time. In addition, once you store your receipts in Paperless 3, you can select the receipts to email them, print them or export them to PDF, or even display them as a graph.

A document management system is an important part of a paperless home office. Like paper, digital or electronic documents need to be stored so they can be retrieved and used as needed. To have an effective paperless office, you need a system to manage these necessary documents.

However, no office can be completely paperless. Some documents must remain on paper meaning that your home office can only be paper-less. And many of us simply remain more comfortable using paper to do some of our work. So any document management system you put together has to manage the mix of electronic and paper for a 'paper less' office.

Advertisement

Advertisement

As designed for large companies, document management systems turn paper into digital images as PDFs that can be stored electronically and, with some software, searched or edited. These systems also can improve electronic filing, retrieving and secure access to information -- and they can be very costly.

However, at its simplest, a document management system consists of a scanner and software that convert paper documents to electronic PDFs. And you can get less expensive software to make PDFs searchable and editable. Here are several options:

- PDF Transformer Pro from ABBYY (for PC only; under $100) will allow you to create PDFs and convert the images to searchable files.

- Acrobat Professional 8.0 from Adobe (for PC or Mac; about $400) creates PDF files, automatically recognizes text with optical character recognition (OCR) and can save the editable PDF files into programs like Microsoft Word.

- NeatShoeBox (for PC only; about $200) scans documents like receipts and business cards, pulls off key information and then exports the data to applications like Quicken and Microsoft Excel and Outlook.

You'll need to develop your own system for managing electronic files. Here are a few suggestions:

- Create an online filing system as you would for paper in a filing cabinet. Use file and document names that will be easy to find and remember.

- Use the 'print to file' option to save electronic documents from outside, like e-mails or online statements, to their correct electronic files.

- Back up your files regularly, probably at least weekly, to a CD or USB flash drive.

- Make a master list of file folders that you can refer to.

- End the year by reviewing your files. Trash any that you no longer need, move files that are going to storage (like the year's invoices) to a CD and set up new files for the new year.

Keep in mind that you'll also have to maintain paper files and weed through them at the end of each year, although these files should be much smaller than before. These documents include notarized documents and materials you need to prepare your taxes.

While you may be tempted to scan your receipts and toss the paper originals, don't do it, says Barry Steiner, a Chicago CPA and former IRS agent. You may need them as proof for a tax audit. Steiner recommends keeping all bills, invoices, receipts and canceled checks related to deductible expenses for three years after filing tax forms. At that point, he says, shred them to prevent identify theft [source: e-mail interview with Barry Steiner].

Paperless 3 0 2 – Digital Documents Manager Job

As Abigail Sellen and Richard Harper, the authors of The Myth of the Paperless Office point out, no office can be completely paperless. 'Rather than pursuing the ideal of the paperless office, [people] should work toward a future in which paper and electronic document tools work in concert,' they write in the book [source: The Myth of the Paperless Office by Abigail Sellen and Richard Harper, MIT Press, 2001, page 21].

Paperless 3 0 2 – Digital Documents Manager Software

For more information on paperless offices and related topics, check out the links below. Reeder 2 0 4 – rss reader.